Maximizing Profit through Sales and Service Contract Alignment

The Problem

Many equipment manufacturers/distributors struggle with the delicate balance of customizing sales and service packages that meet the price sensitivities of their customers while ensuring they are not artificially eroding margin through hidden costs. The ideal circumstance for any dealer would be to sell a customer a 100% reliable unit while at the same time selling an associated maintenance and service agreement at the highest acceptable price point. This, in effect, eliminates the associated maintenance and service costs and converts its contract sale to pure gross profit. If only price sensitive customers, misaligned sales incentives and equipment failures didn’t exist!

The Scenario

Josh Wyman is a sales representative from American Pure Air, Inc., a manufacturer and distributor of industrial dust collector systems. He is in the midst of selling ten of their newest collection units to a major automotive manufacturer. The facility manager and corporate buyer are extremely aggressive in negotiating the sale of the units. While they’ve only asked for a 5% reduction on the price of each unit, they are pressing for a 60% reduction in the cost of the 5 year maintenance and service agreement.

Josh realizes that the 60% reduction in the maintenance and service agreement represents a substantial revenue cut on the overall sale of the unit. However, Josh rationalizes that the deal is reasonable based upon his belief that the costs associated with performing the maintenance and service agreement are relatively low and would be more than compensated for by the margin in the unit sale. Josh rationalizes the following transaction model:

| Unit Price | Unit Discount | COGS | M&S Price | M&S Discount | M&S Cost | Margin |

| $8000 | $400 | $5600 | $2000 | $1200 | $1400 | $1400 |

This model represents a 16.7% margin.

Where:

COGS = Cost of Goods Sold (Material, Manufacturing and Logistics Cost)

M&S Cost = Cost to Maintain and service the equipment ($35/hr X 4 hrs/yr X 5 Yrs + $700 Parts)

Unit Discount = 5% of Unit Price

M&S Discount = 60% of M&S Price

The optimal model for the company under the same negotiating parameters would look more like this:

| Unit Price | Unit Discount | COGS | M&S Price | M&S Discount | M&S Cost | Margin |

| $8000 | $0 | $5600 | $2000 | $0 | $1400 | $3000 |

This model represents a 30.0% margin.

Josh will leave an exceptional amount of money on the table by rationalizing the deal the way that he has. However, there is another huge catch that’s not been mentioned yet: Josh’s commission is solely based on the revenue from the unit sale! This makes the decision really easy for Josh.

The Formula for Success

Max (Margin) = Max (Sales Revenue) + Max (Maintenance and Service Revenue) – Min (COGS) – Min (Cost of Maintenance and Service)

Needless to say, the formula above may be a bit of an oversimplification but still remains valid. When selling equipment along with maintenance and service agreements it is imperative that the deal is looked at holistically. In order to maximize the value on the deal a front line salesperson would need to have an understanding of what parameters affect the outcome of the deal and of course should be incentivized to act accordingly. Below are a few practical tips to ensure basic sales alignment with maximum value capture:

- If at all possible, separate the sale of the equipment and associated maintenance and service contracts. (Beware not to introduce needless process breakdowns leading to missed sales)

- In instances where sales transactions cannot be separated the commission structure for the overall deal should designed to incentivize protection for both revenue streams.

- Communicate COGS and Costs of Maintenance and Services to front line sales representatives prior to structuring any deals.

- Establish hard limitations for discounts based on volume and margin to protect against non-profitable deals

- WALK AWAY from lopsided deals that breach the set parameters of profitability!

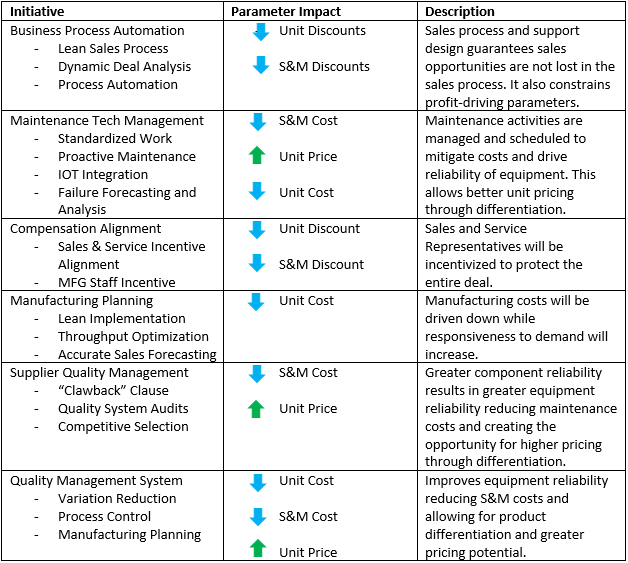

Below are some of the best practices to employ to maximize your sales margin:

The position that American Pure Air, Inc. strives for through proactive strategic planning and focused product improvement tactics is:

| Unit Price | Unit Discount | COGS | M&S Price | M&S Discount | M&S Cost | Margin |

| $8600 | $0 | $5000 | $2000 | $0 | $1000 | $4600 |

The organizations that will win the competition or consumers will be the ones that are able to best differentiate themselves to remain relevant. What is not mentioned in the example above is the expected future returns from repeat customers and the implications of competition in the customer’s decision making process. I will discuss the implications of such game theoretic in a future post.

By employing the tactics and strategies above, it is possible to increase the customer’s willingness to pay as well as reduce costs for future products that are purchased. If you would like to know more around the details and best practices to differentiate your product and brand please contact us:

Starr & Associates Management Consulting

1-888-727-3017

information@starrconsultant.com